Become an Attractive Risk for Underwriters

Insurance Journal

AUGUST 12, 2024

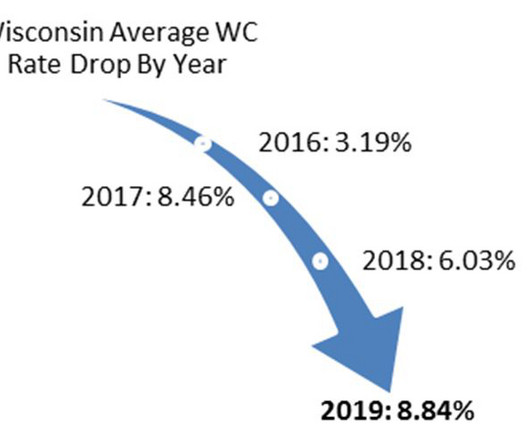

Insurance Carriers are reducing their appetite for risk and increasing premiums. This means they are being much more selective in what they are willing to insure. This post is part of a series sponsored by TSIB. If they are going …

Let's personalize your content