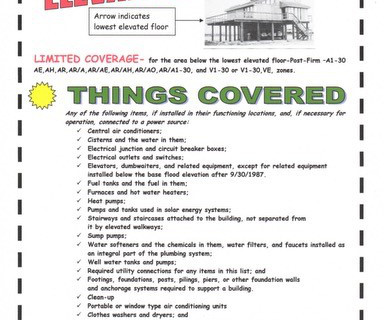

Hurricane Helene Flood Insurance Claims and Elevated Building Issues? Refer to the Visual Flood Adjusters Use

Property Insurance Coverage Law

OCTOBER 6, 2024

I have received numerous calls from furious Hurricane Helene policyholders after learning how little coverage is afforded for the non-elevated floor of a multi-story building under their flood insurance policies. Refer to the Visual Flood Adjusters Use appeared first on Property Insurance Coverage Law Blog.

Let's personalize your content