Florida Legislators to Investigate Whether Property Insurers Used Accounting Tricks to Hide Profits

Property Insurance Coverage Law

MARCH 5, 2025

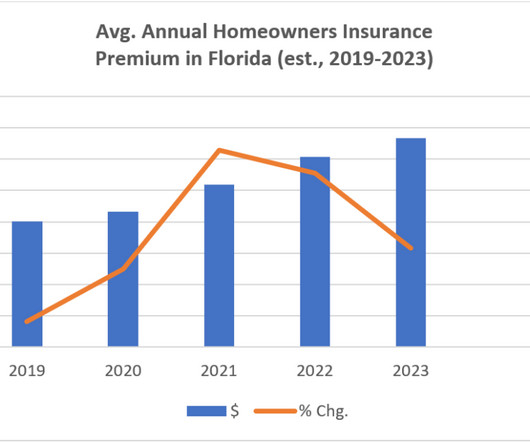

A new investigation into Floridas property insurance industry is set to begin, raising significant questions about insurer profitability, financial transparency, and the true reasons behind skyrocketing premiums for policyholders.

Let's personalize your content