The Rising Insurance Crisis: Advocating for Policyholders Beyond the Courtroom—Dr. Phil Primetime with Steven Bush

Property Insurance Coverage Law

JANUARY 18, 2025

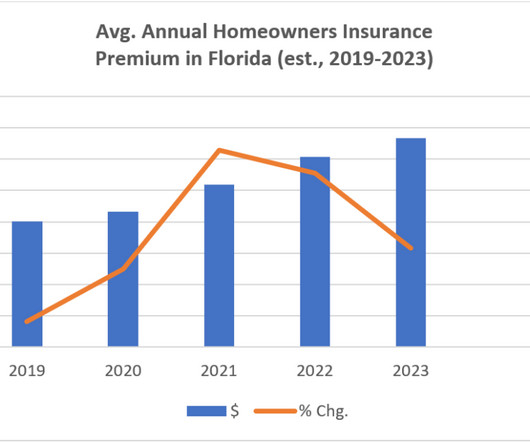

Premiums have soared, and coverage options have dwindled, leaving countless families vulnerable to financial ruin. As … The post The Rising Insurance Crisis: Advocating for Policyholders Beyond the CourtroomDr. Millions of Americans have faced an escalating crisis with their homeowners insurance.

Let's personalize your content